Impact Investing is a topic of emerging interest in the development space in Bangladesh, as the country moves towards becoming a middle income country and traditional sources of funds (e.g. donor grants) are being channeled towards countries with more compelling needs. Impact investments have also triggered the interest of traditional for-profit companies which work with solving a social problem (for example agribusiness, health services), as an alternative financing source.

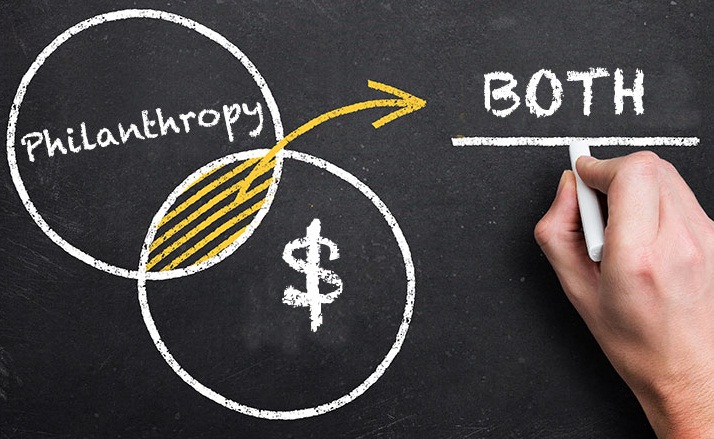

According to the GIIN, impact investments are investments made into companies, organizations, and funds with the intention to generate social and environmental impact alongside a financial return. Impact investors are strong advocates of the fact that social impact and financial returns are not necessarily mutually exclusive. This inherent need for a blended return distinguishes an impact investment from traditional sources of finance. The deliberate strategy for positive benefit to society separates an impact investment from loans and equity investments while the inclusion of a financial return differentiates it from grant funding.

With a portfolio of numerous programmatic interventions and over a dozen profit generating enterprises, perhaps no other organisation in Bangladesh is more equipped to receive impact investment funds than BRAC. Such investments can be utilized at many of our enterprises which are looking to increase their capacity, as they face increasing competition from private sector players which have more aggressive investment plans, newer technology and greater business acumen. Infusion of impact capital could also be a possibility in the BRAC programs which are venturing into the domain of social enterprises.

Do we really need outside investors? Doesn’t BRAC already have its own funds? How about donor funds or bank loans?

One of the most important decisions for any enterprise before choosing a source of fund is the cost of the fund, i.e. how much we will be paying to use the money on offer. Compared to the high interest rates of bank loans and market returns required by traditional investors, the return required by impact investors often tend to be lower than market rates of return. This is because impact investors care more about the combination of financial and social return and thus can afford to sacrifice a certain portion of the monetary return in exchange of a greater social impact.

Impact investments are also termed as patient capital since such investments are long term in nature and investors do not expect a return from Day 1. Moreover, traditional banks and lending institutions are often hesitant to loan out money to social enterprises that earn below a certain level of profits.

Although donor funds are considered ‘free money’, it is often not available to ventures which seek to generate profit, thus cannot be considered to be a sustainable source of fund for programs moving towards a social enterprise structure.

It is also important to note that when we talk about bringing in ‘investors’ as opposed to ‘donors’, we are actually talking about sharing a part of the ownership of the enterprise with the investor. Although many look at investors with a skeptical eye, fearing a dilution of ownership, such institutional investors rather bring with them a vast amount of external expertise from their involvement in various social enterprises across varied sectors and geographies. Such investors also provide advisory and management support services to help the enterprises run their day to day operations and reach scale. This is a particularly interesting proposition for BRAC programs which are just starting their social enterprise journey and require assistance to strengthen their business cases. Mature enterprises looking for new ideas to generate growth could also benefit from such expertise.

This sounds interesting. But are BRAC’s programs and social enterprises ready to receive impact investments?

For any impact investor, the two most important parameters for making an investment into an enterprise are: i) a clearly defined and financially viable business case and ii) a measurable social and/or environmental impact.

A common saying among investment managers across the world is “You only get what you measure”. Since an infusion of external impact investment requires an enhanced reporting of financial and social impact, it would also require both our enterprises and programs to follow a more robust monitoring and reporting structure.

For financial returns, it is not sufficient only to look at the top line (revenue) and bottom line (profits) but it is equally important, if not more, to also focus on key financial metrics like profit margins and return on investment. Figuring out the metrics for social impact is a bit trickier. However, the importance of monitoring, recording and reporting of social impact cannot be stressed enough. It is not sufficient for the programs and enterprise to just have good intentions and an inbuilt sense of purpose, it is equally important (if not more) to translate those intentions into measurable, quantifiable and standardized measurement practices.

Social impact assessment is one area which deserves particular attention at our current enterprises.

So where can we get these funds? Show me the money!

There are at least 15 impact investors currently active in Bangladesh with a total of USD 955 million in deployed capital. Most of these investments have been deployed in sectors such as ICT Energy, Financial Services, Agriculture/ Food Processing, Infrastructure, Microfinance and Manufacturing. The most common sources of such funds in Bangladesh are Development Financial Institutions (DFIs) like International Finance Corporations (IFC) and FMO (Dutch Development Bank). Funds are also available from philanthropic foundations like Bill and Melinda Gates Foundation and Rockefeller Foundation as well as from established international impact investors like Omidyar network, Acumen Fund and Dalberg. Both IFC and Bill and Melinda Gates Foundation have made significant investments in our very own bKash and their investment model is a good example that could be replicated across our enterprises and programs.

The government has also embraced this idea of impact based capital and taken initiatives to create an enabling regulatory environment for impact investment in the country. With the introduction of the Alternative Investment Act, 2015, traditional financing companies and new private equity companies in Bangladesh have started making investments into local private companies.

Here’s looking forward to the infusion of impact investment into the BRAC space to drive the sustainable development agenda!