On my second day at Social Innovation Lab, BRAC, I had the chance to attend a workshop on ‘Women and Finance’ organized by IDEO.

As you may know, IDEO is a global design firm that aims to create positive impact across both social and for-profit sectors. For this particular workshop, they wanted to disseminate learning and obtain expert feedback on their research on ‘Women and Finance’.

Bangladesh is the fourth country they are researching on, for ideas on how to innovate ways for women from rural or disadvantaged households to interact with mobile money. The idea is to study different country contexts and apply the insights to prototype and pilot some innovative solutions.

Picture: Women and Money workshop at Bistro E, Dhaka.

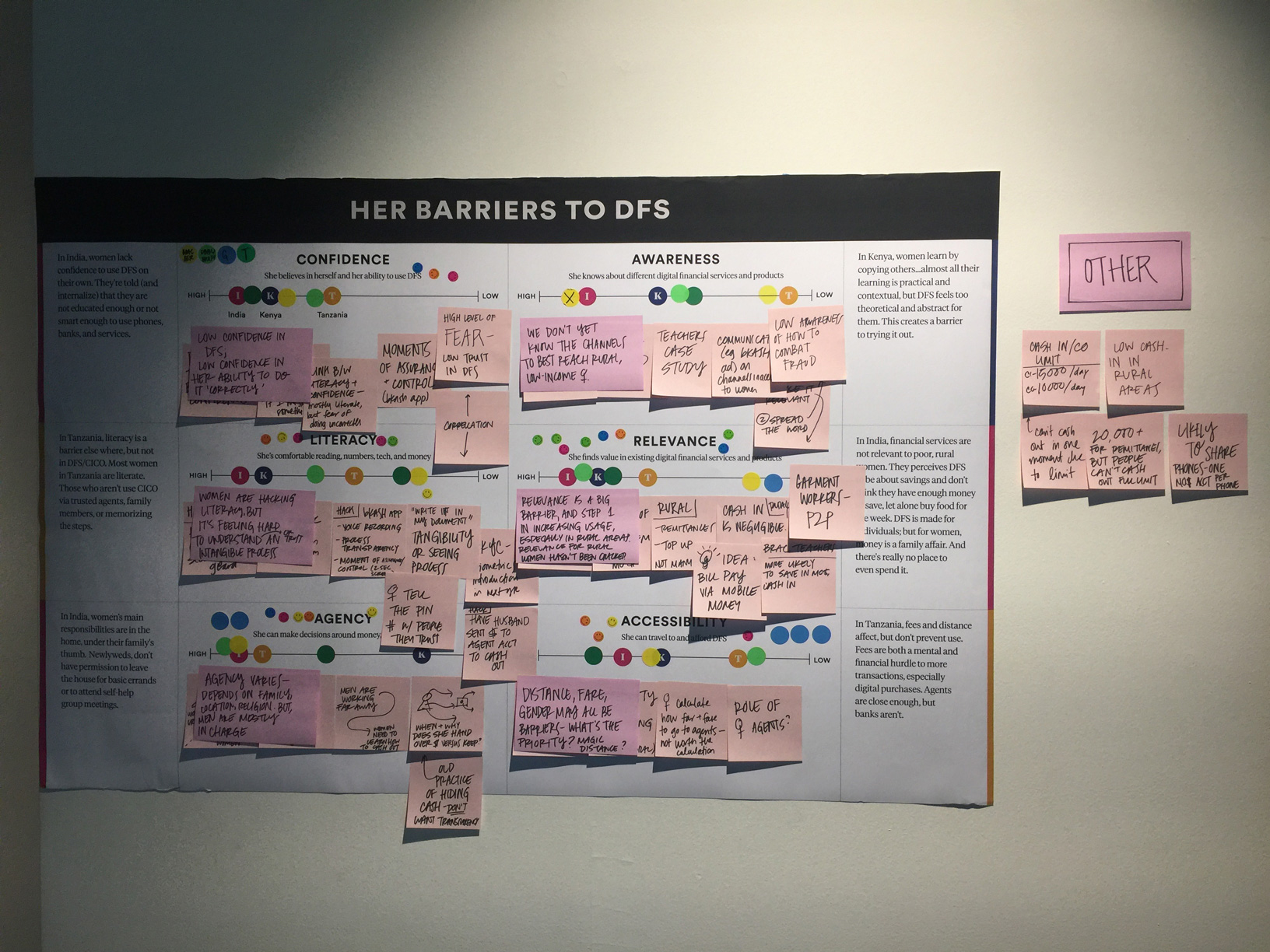

IDEO’s research has unveiled that irrespective of geographical location, there are 6 major barriers that women face in using digital payment methods, which namely are:

- Confidence in trying out new solutions

- Level of literacy

- Personal Agency/Opportunity to do things by themselves

- Awareness of digital financial services and how they function

- An understanding of if cashless transactions are relevant to their needs

- Accessibility to digital payment facilities

The discussion – which featured representatives from BRAC, bKash and Rocket, among others – unveiled some interesting insights. For example, many women find it a hassle to travel to crowded market places to access digital payment services, and would rather ask a male relative to instead transact for them, or opt to save their money inside their homes.

On the other side, we found that many women, despite being aware of cashless payment systems, feel unconfident to to attempt such transactions. They fear making mistakes while transacting and losing their money. Often, if they have to transact, they tell their secret PIN number to the mobile money agent, leaving them vulnerable to fraud.

Interestingly, we found that technophobia is a big barrier for Bangladeshi women. Technophobia is the constant and persistent fear of technology and in greater depth, is defined as “the feeling of severe anxiety associated with using anything technologically advanced. It is a highly studied phobia (Jacob, N.D). In Bangladesh, women are aware of digital payment systems but they are doubtful of whether these systems are meant for users like them. Even highly educated women also want to double confirm their steps before completing transactions.

Moreover, the regulation-mandated ceiling for cashing out remittances and other monies makes it difficult for women – and men – to transact large volumes of cash all at once, and is a major pain point for mobile money users.

After the discussion, IDEO proposed some new ideas that they wanted the experts’ opinions on. The ideas included options like saving money in accounts to access income generating opportunities, taking agents to the doorstep of rural women to personally teach them about digital finance, voice activated application to lead women through transactions, and even free savings counselling for newly wedded couples. The experts debated on the viability and feasibility of the ideas, and generated more ideas of their own.

Picture: Her barriers in using digital payment method.

They agreed that while steps needed for digital transactions can be hassling, they are necessary for the users’ personal account safety. But perhaps a smarter way of reducing the steps could be developed to retain and attract more customers.

Secondly, an ecosystem for digital transactions needs to be created, especially in rural regions where people do not have enough opportunities for cashless transactions. If more opportunities arise for digital payment, it is expected that the volume of transactions and users would increase.

Another interesting suggestion was to hire more female agents or create women-friendly transaction spaces, where women can be taught to use digital payment solutions, and do transactions without having to travel to crowded marketplaces.

All in all, this was a wonderful learning opportunity, and I am excited to see how Phase 2 of IDEO’s research – where they prototype new solutions – plays out.