new wallets till date

percent wallets belong to women

bKash transaction within BRAC in 2018

clients regularly use mobile money for savings installments

million people trained on mobile money in 2018

cashless BRAC schools

teachers get salary in their mobile wallet

extension workers trained on bKash in 2018

staff members trained on bKash in 2018

cashless payment for lunch at headquarters

staff members receive allowances through bKash

health workers to get paid through bKash by end 2019

clients in remote shoals and wetlands

CSAs to become bKash agents by 2020; 700 till date

cashless micro finance branches in remote areas

Many women reap the benefits of mobile money beyond BRAC services by adopting bKash for convenience and to improve their wellbeing. Access to digital financial services means that women can receive money directly and keep it safe.

Women are often tasked with managing household financial transactions such as paying bills, receiving money, and buying goods and services, even when they don’t have access to formal financial institutions. It should be no surprise then, that once BRAC clients gained the confidence to use mobile money, they quickly began to explore possibilities to make their lives more convenient and financially secure.

Many women reap the benefits of mobile money beyond BRAC services by adopting bKash for convenience and to improve their wellbeing. Access to digital financial services means that women can receive money directly and keep it safe.

Research shows that mobile money lessens risk of significant financial shock through access to remittances and lending within a group. Direct disbursement also provides women with a certain level of privacy and autonomy to reinvest funds as they deem fit. When women become financial decision makers, savings increase and labour force participation improves.

The CSA app looks simple. Deceptively simple. Building it was not so at all.

My name, my real name is Aegon Targaryen

Total bKash agents

in 6 sub-districts

2,351

bKash agents in 2019

383

bKash agents in 2015

bKash agents in 2019

bKash agents in 2015

When BRAC began its work with the Innovation Fund in 2013, it had not anticipated the extent to which the impact of mobile money training would spill over. Women have proven themselves to be agents of change, driving grassroots uptake of mobile money within and beyond their immediate network. If a woman adopts mobile money, it creates significant ripple effects throughout the larger ecosystem. She will in turn introduce it to her family, friends, and neighbors. Women have also proven themselves to be significant drivers of economic growth.

Increasing financial inclusion for women through access to mobile money in turn creates a more efficient, productive, and transparent economy.

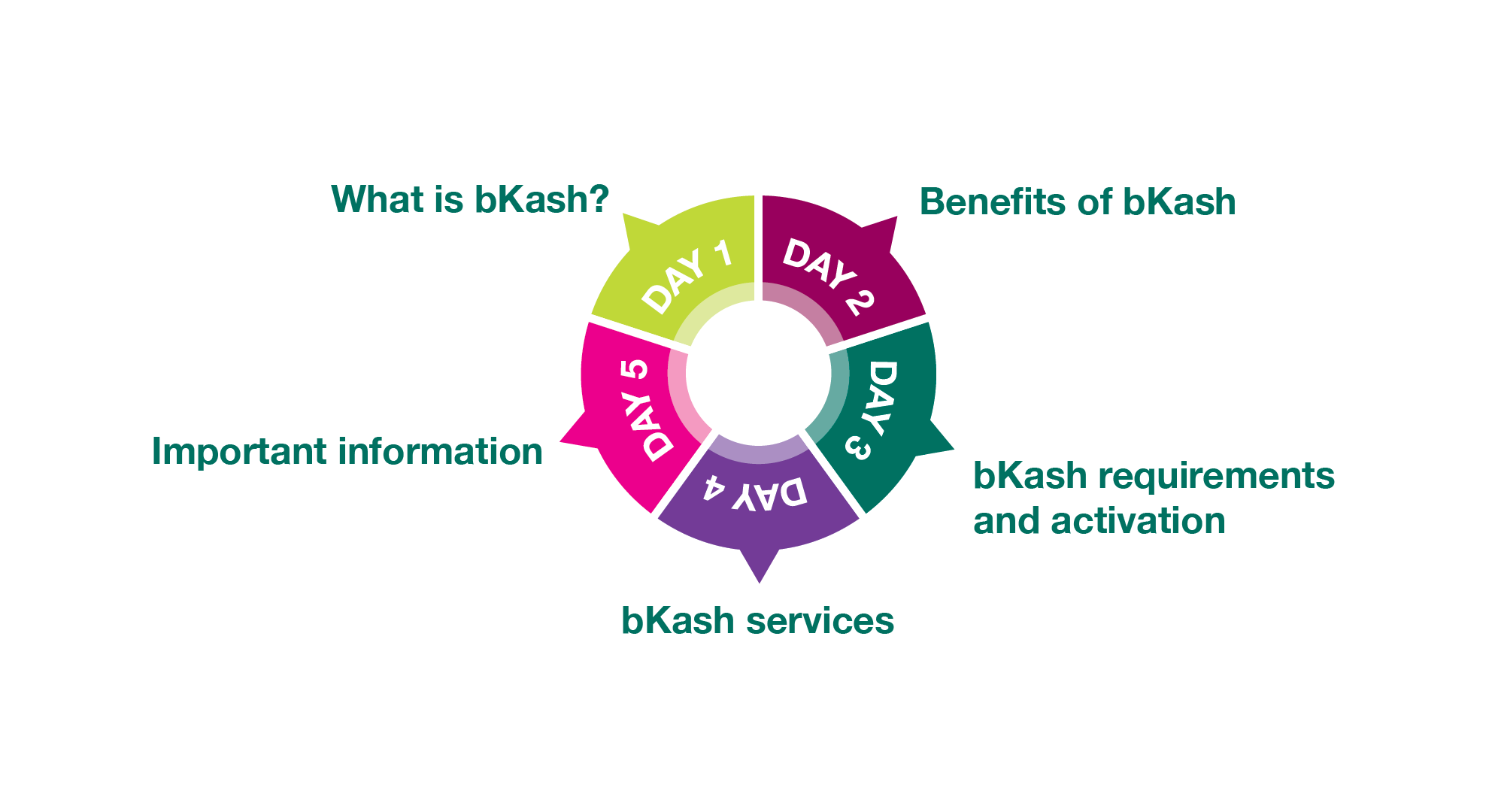

BRAC has spent the past five years identifying and addressing primary barriers to mobile money adoption for women. The largest NGO will have opened over 1 million bKash accounts across the country by 2019 and trained more than six million clients, mostly women. From digitizing salaries to promoting bKash for savings schemes, BRAC has identified ways to catalyse financial inclusion through mobile money....

The power of mobile money to transform the economic lives of women — and their larger networks — is clear. And BRAC is trying to make full use of that potential as it strives to develop products and services targeting new population segments to ensure that no woman is left behind on the journey to financial inclusion. This includes digitisation of wages for ready-made garment workers and piloting loan products for Facebook-based entrepreneurs. Achieving gender equality in financial services, however, will require a multifaceted response that reaches far beyond ensuring meaningful access. Most critically, regulators will need to explore ways to further foster use of mobile money by lifting transaction fees and limits, for instance. Research demonstrates that women transact with mobile money at a lower rate than men due to greater price sensitivity. If partners across Bangladesh can come together in developing a regulatory environment conducive to inclusivity, then financial inclusion for all will not remain a dream any more. It will become the reality.