BRAC has today announced that the Frugal Innovation Forum 2020, scheduled to take place from 18 to 20 April, 2020 will be postponed following the global outbreak of the COVID-19 (Coronavirus). This difficult decision was reached after careful monitoring of the COVID-19 escalation and consultations with health experts.

The Frugal Innovation Forum is a unique platform by practitioners, for practitioners, to converse and ideate solutions for communities in the Global South. This year’s forum intends to host global practitioners, thinkers, researchers, policymakers and financial ecosystem partners to brainstorm solutions to the enduring challenges in financial inclusion for women through digital services. We remain as committed as ever to this forum and plan to reschedule for later this year.

We are moving as swiftly as possible to decide how we might use this opportunity to come together in new ways. Your safety remains our utmost priority, as governments, entities and communities navigate these difficult circumstances to the best of their abilities.

1.7 billion adults in the world are unbanked. Among them, more than half are women.

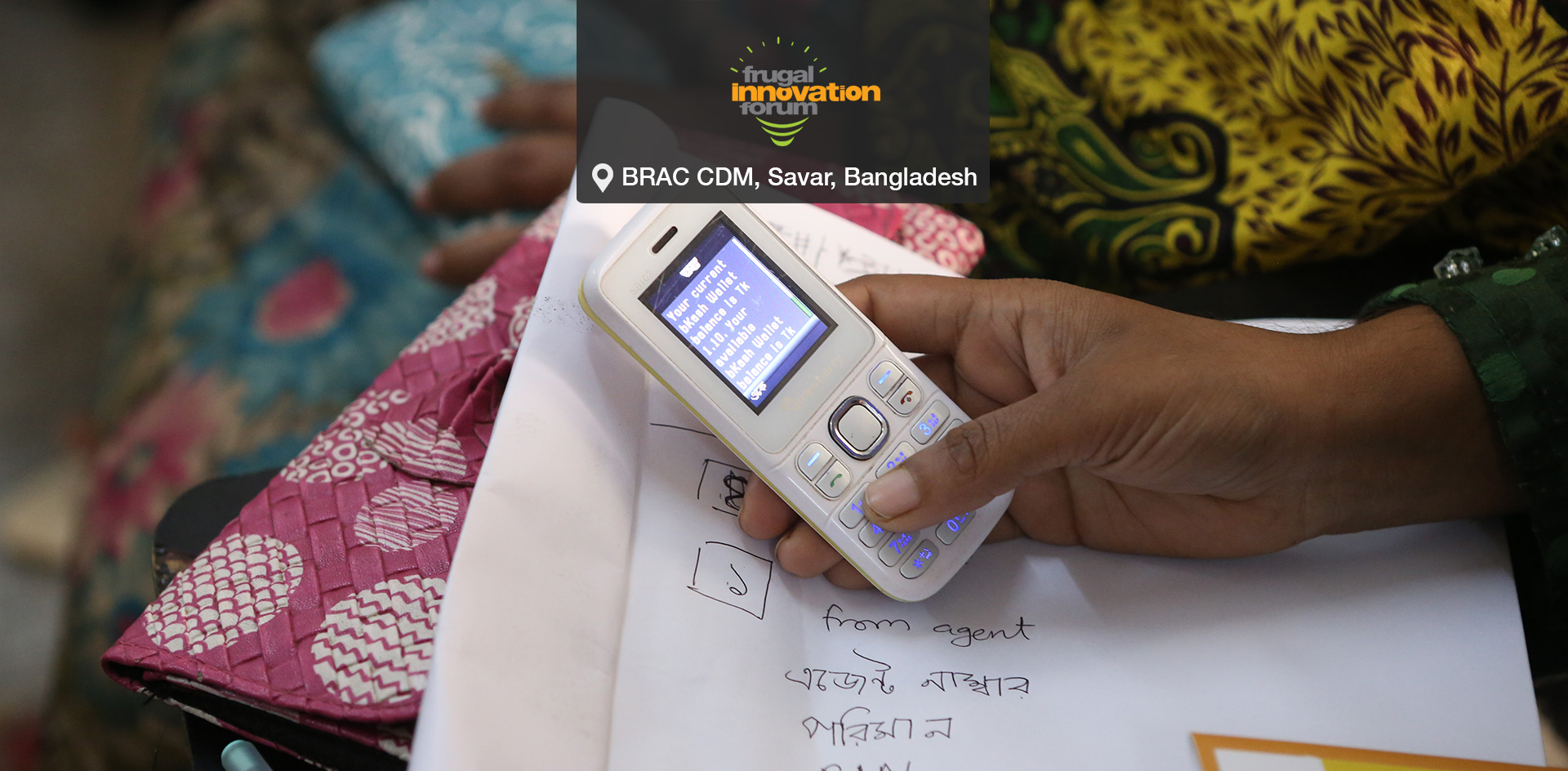

The rise of digital financial services is expected to advance women’s financial inclusion. Yet, there is a persistent gender gap in account ownership. In Bangladesh, the gap is 29 percentage points, the highest in the world.

How can we find simple solutions to the many challenges that impede women’s financial inclusion?

The 7th Frugal Innovation Forum will bring together global practitioners, thinkers, researchers, policymakers and financial ecosystem partners to brainstorm solutions to the enduring challenges in financial inclusion for women through digital services.

FIF 2020 will aim to:

- Deepen our understanding of ecosystem drivers that enable digital financial inclusion for women

- Take stock check of evidence and use cases to identify what has and hasn’t worked for women’s financial inclusion

- Identify steps for reducing exclusion and explore opportunities for partnerships to tackle it

- Focus on targeted and/or emerging innovations addressing unbanked women – and identify roadmap to maximise their impact

Let’s come together at Savar, Bangladesh to explore grassroots progress, evaluate evidence for impact, and forge effective partnerships to maintain momentum in delivering financial inclusion.

Tentative agenda

Field exposure visit

9.00am - 9.15am

Welcome message

9.15am - 9.30am

Keynote

9:30m - 10:30 am

Have digital financial services delivered on their promise to women?

10.30am - 11.00am

Soapbox

11.00am - 11:30pm

Coffee Break

11:45pm - 1:00pm

- From access to empowerment: How do we help low literacy clients adapt?

- Exploring possibilities: Developing use cases that matter to women

- Workshop: Nudging clients to encourage uptake

1.00pm - 2.30pm

Lunch and networking break

2.30pm - 3.30pm

- Harnessing the power of proxies to champion women’s financial inclusion

- Wage digitisation: Is it working for women?

3.30pm - 4.00pm

Coffee break

4.00pm - 5.30pm

Access first, use later.

5.30pm - 6.00pm

Inauguration of exhibit space

6.00pm - 8.00pm

Entertainment

9.00am - 10:00am

A name to blame: Who is responsible for ensuring digital financial inclusion?

10:15 am - 11:15 am

- Transforming DFS: the emerging role of super platforms for women’s financial inclusion

- NextGen tech for financial inclusion: Can DFS be made easier still?

- Bringing back-end operations front and center

11:15 am - 11:45 am

Coffee break

11.45 am - 1:15 pm

- Evidence on women’s economic empowerment through DFS and making a difference through data informed decisions

- The Dark Side of DFS: data confidentiality and consumer protection

1.15pm - 2.30pm

Lunch and networking break

2.30pm - 3.30pm

Rethinking regulation for digital financial inclusion

3.30pm - 4.00pm

Coffee break

4.00 pm - 4:30 pm

Soapbox

4:30pm - 5:15pm

What’s next for financial inclusion?

5:15pm - 5:45pm

Closing reflections and remarks

Speakers

Dr. Rubana Huq

President , Bangladesh Garment Manufacturers and Exporters Association, BGMEA

@Rubanahuq

Shameran Abed

Senior Director, Microfinance, Ultra Poor Graduation, BRAC and BRAC International

@Shameran

Rajeev Kumar Gupta

Programme Manager, SHIFT ASEAN & SAARC, UNCDF

Cheng Cheng

Director, Expansion, Tala

Kamal Quadir

Chief Executive Officer, bKash

Farmina Hossain

Additional Director, BURO Bangladesh

Syeda Ishrat Fatema

Team Lead, Sarathi Project, Swisscontact

Smita Nimilita

Country Rep, HERProject, Bangladesh, BSR

Kathy Guis

Senior Director, Partner Investments, KIVA.org

Afsana Islam

Private Sector Development Adviser and Deputy Team Leader, Growth and Private Sector Development, DFID

@IslamAfsana

Sarfraz Shah

Director of Insurance, PULA

Rakib Avi

Programme Coordinator, Executive Director's Office and Social Innovation Lab, BRAC

@RakibAvi

KAM Morshed

Director, Advocacy for Social Change, Technology, and Partnership Strengthening Unit, BRAC

@kmorshed

Mercy Wachira

Digital Innovation and Implementation Lead, Microfinance, BRAC International

@cremywachira

Olayinka David-West

Professor of Information Systems & Digital Financial Services Specialist

@ydavidwest