Month: April 2019

Intro Below Text

We have dedicated this booklet to the women of BRAC: those we work for, and with. In it, we will highlight three key drivers we have identified behind the persistent gender gap in Bangladesh, and the steps we have taken in response.

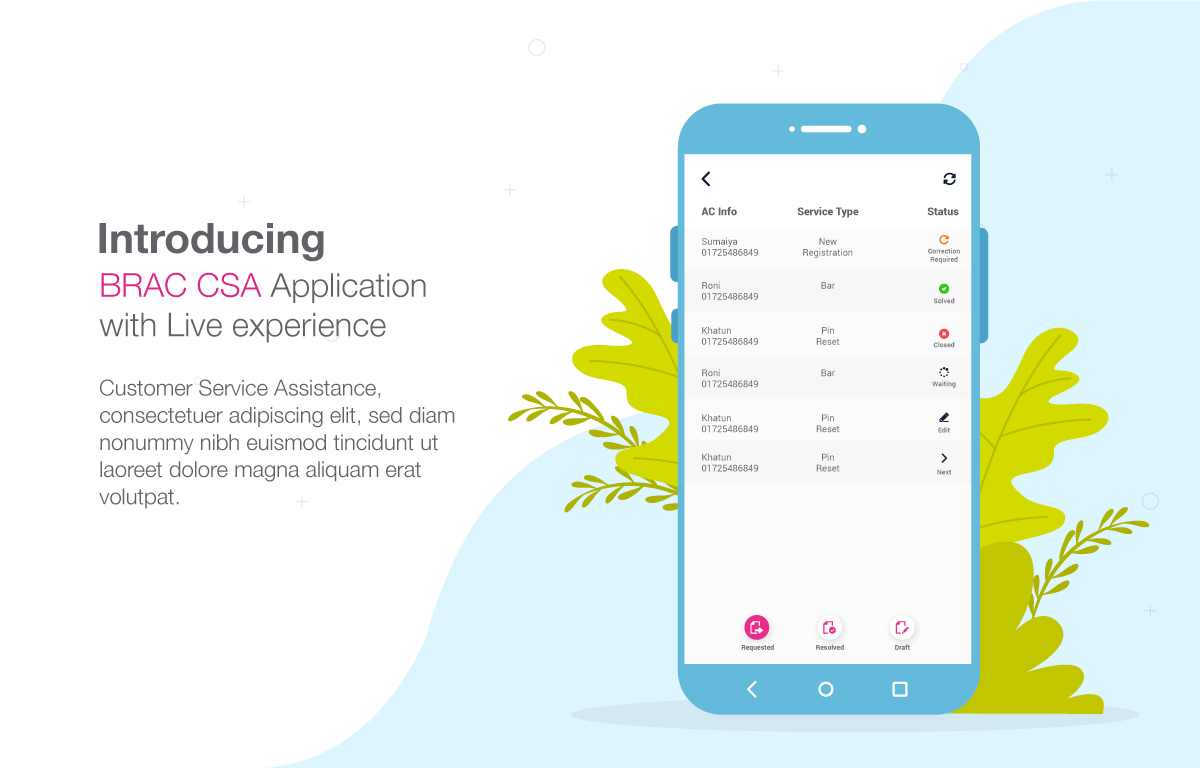

Address pain points of wallet registration

There was a time when women had to go to the nearest market to open a bKash wallet. This alone was an inconvenience for several reasons. The market can be chaotic and crowded with men – not always a welcoming place for a woman. She had to wait for the long line of customers to complete transactions before the bKash agent was ready for her. More often than not, the agent would be a male who would show the woman how to handle bKash while standing close. Together with a commute of several hours, jostling with the crowd and enduring lewd glances and transacting in the market tended to become very prohibitive for women.

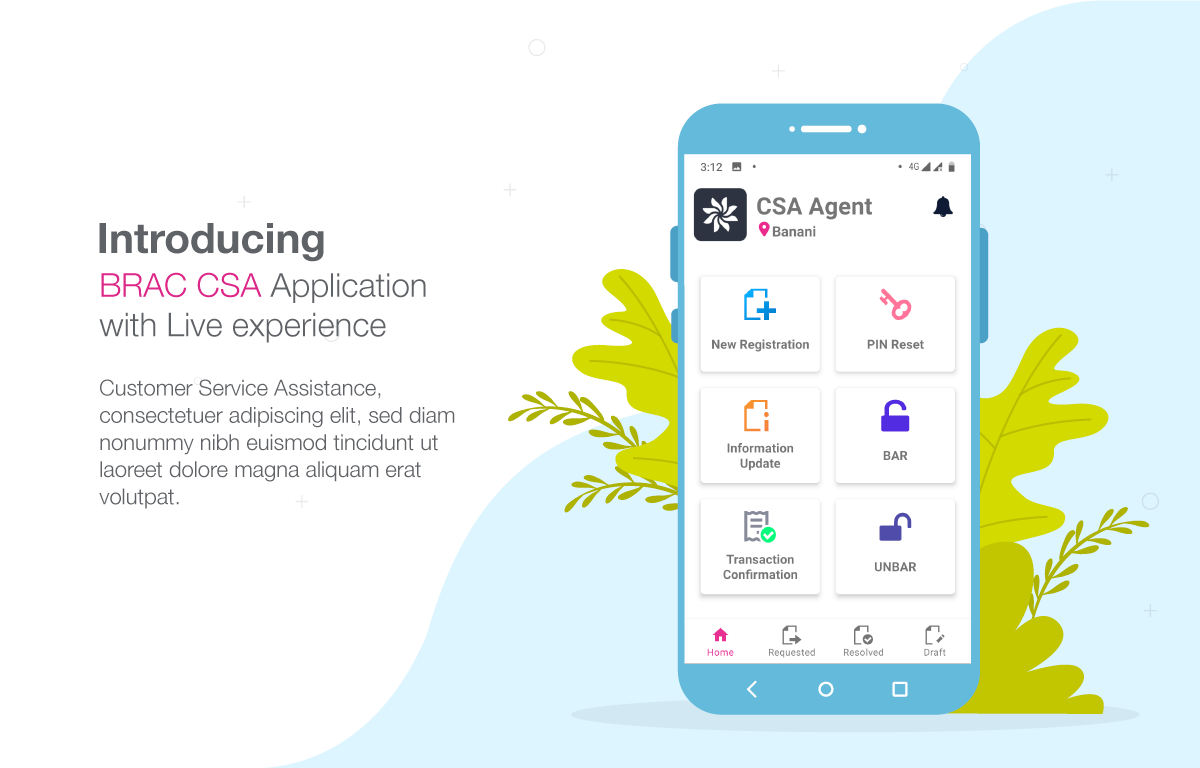

BRAC introduced bKash account opening services through customer service assistants (CSA) and project staff (PS) across its Microfinance, Integrated Development, and Education Programmes in 2016 to circumvent the marketplace and encourage new users to take the first step in their mobile money journey. With women able to open bKash wallets at the nearest BRAC office, the scenario changed. The commute was shorter. There were no crowds. They could stand in queue with other women and feel completely at ease. BRAC staff were available at short notice to facilitate introduction to this new platform, even ready to visit a client’s backyard for further assistance.

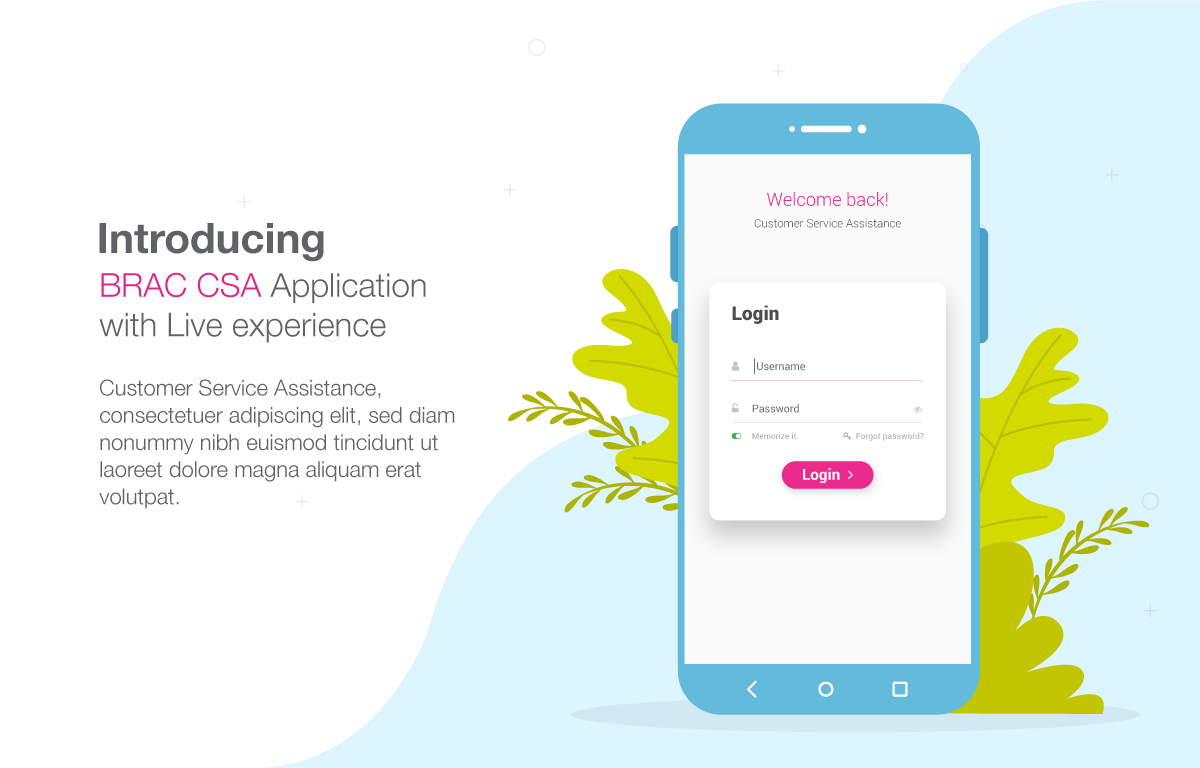

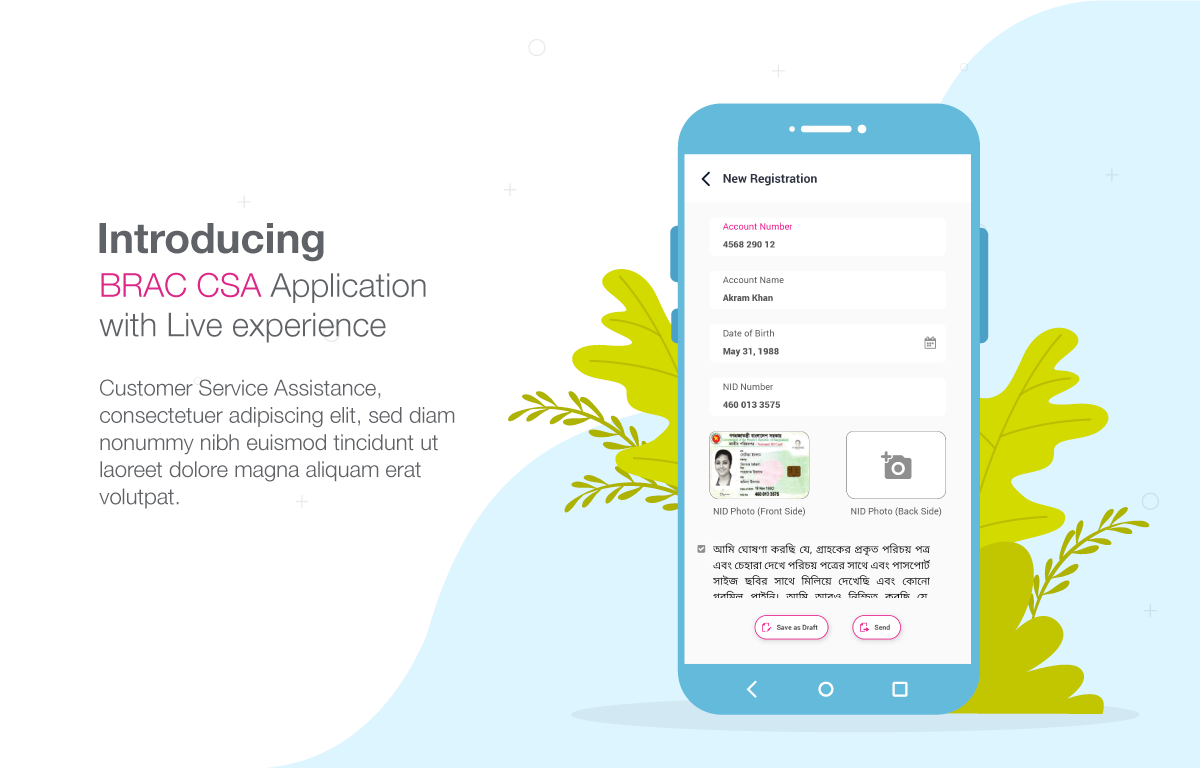

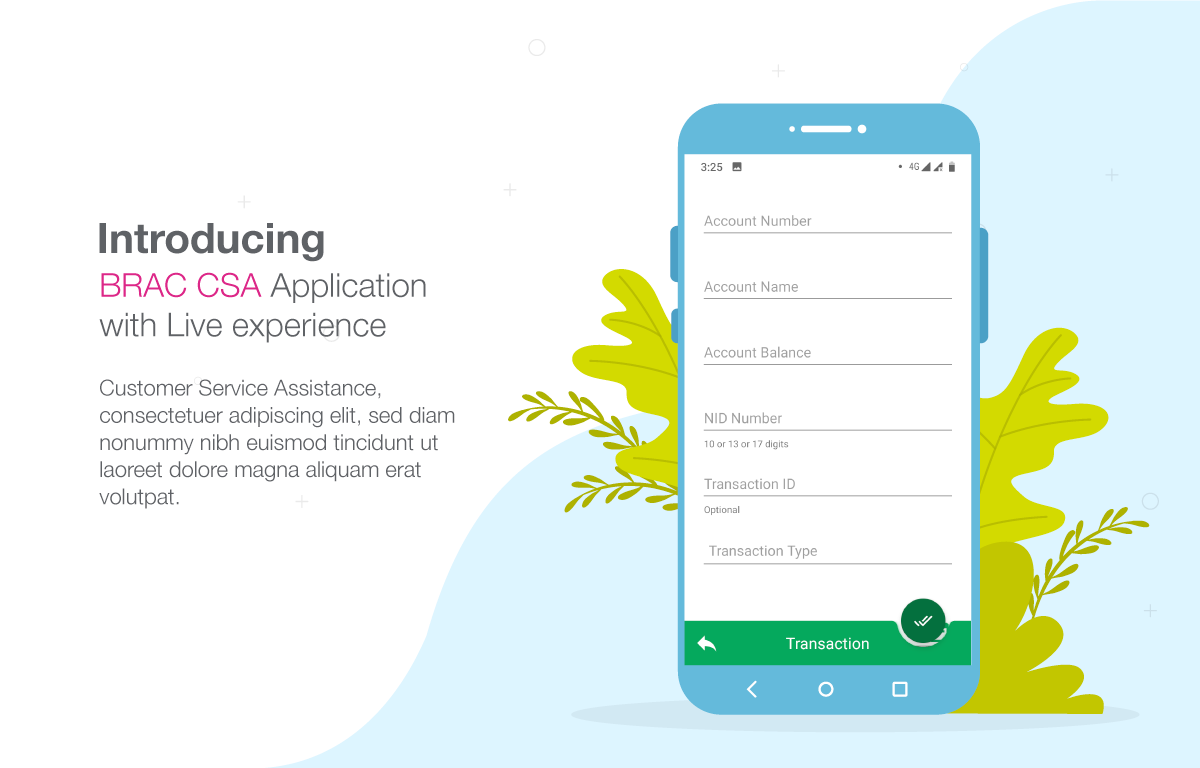

Trained BRAC personnel introduce clients to the bKash application before opening a wallet, through the story of a fictional character teaching new users how to add or remove money from the virtual wallet. They are then familiarised with the buttons and basic functions on mobile phones. BRAC staff modify this introduction according to local context and circumstances of clients. The BRAC CSAs and PSs are trained to then collect national IDs and colour photographs, and to complete the Know Your Customer (KYC) forms on behalf of the clients. Once wallets have been approved, the CSAs work with clients to finalise account opening, including PIN set-up.

Prior to the introduction of CSAs, bKash agents would often set up PINs instead of teaching the women how to do it, compromising security. CSAs on the other hand are skilled at helping clients create PINs that they easily remember. They also emphasise digital wallet safety by reminding the clients time and again not to disclose their PIN to anyone, ever.

One size doesn’t fit all – tailoring services

BRAC began its mobile money journey by mapping critical factors behind the gender gap in Bangladesh. Drawing upon research and best practices in the Global South, as well as a deep understanding of its clients’ realities, BRAC developed contextualized, responsive solutions. Five years later, 78% of bKash wallets it opens are for women, more than two-thirds of whom are active users. This is well above the national average of 35% active users. It was not easy to achieve.

App-slide3

Introduction

It was obvious from the outset that improving women’s access to digital financial services would become a thrust area of the Innovation Fund for Mobile Money. Since the project’s launch in 2013, BRAC Social Innovation Lab has partnered with the Bill & Melinda Gates Foundation to experiment with mobile money services and products. We initially piloted within a number of programmes before deciding to scale our solutions in Microfinance, Education, and Integrated Development. The project has since introduced female clients to mobile money through savings products, salary and school fee collection.

The reason to primarily focus on women was that anecdotal experience and research both indicate that household expenditure on food and education increase when women have greater control over income. Further, women are more likely to save and use those savings to invest in their own businesses and in a better future. And the benefits of closing the gender gap in financial inclusion don’t stop with women or remain limited to the present. Greater equality also enhances economic productivity and improves development outcomes for the next generation.

This booklet is our fourth in a series documenting the experience of scaling mobile money. And this time, we have dedicated it to the women of BRAC: those we work for, and with. In it, we will highlight three key drivers we have identified behind the persistent gender gap in Bangladesh, and the steps we have taken in response. We will describe how our female staff and clients have tested, adopted, and (most importantly) adapted mobile money in ways that make sense for them. And we will share our observations of the power of women in acting as agents of change: how progress towards financial wellbeing is not limited to just a single client opening a wallet, but ripples outwards to encompass families, communities, and economies.