Many women reap the benefits of mobile money beyond BRAC services by adopting bKash for convenience and to improve their wellbeing. Access to digital financial services means that women can receive money directly and keep it safe.

Month: April 2019

Ripple Effects

Women are often tasked with managing household financial transactions such as paying bills, receiving money, and buying goods and services, even when they don’t have access to formal financial institutions. It should be no surprise then, that once BRAC clients gained the confidence to use mobile money, they quickly began to explore possibilities to make their lives more convenient and financially secure.

Many women reap the benefits of mobile money beyond BRAC services by adopting bKash for convenience and to improve their wellbeing. Access to digital financial services means that women can receive money directly and keep it safe.

Research shows that mobile money lessens risk of significant financial shock through access to remittances and lending within a group. Direct disbursement also provides women with a certain level of privacy and autonomy to reinvest funds as they deem fit. When women become financial decision makers, savings increase and labour force participation improves.

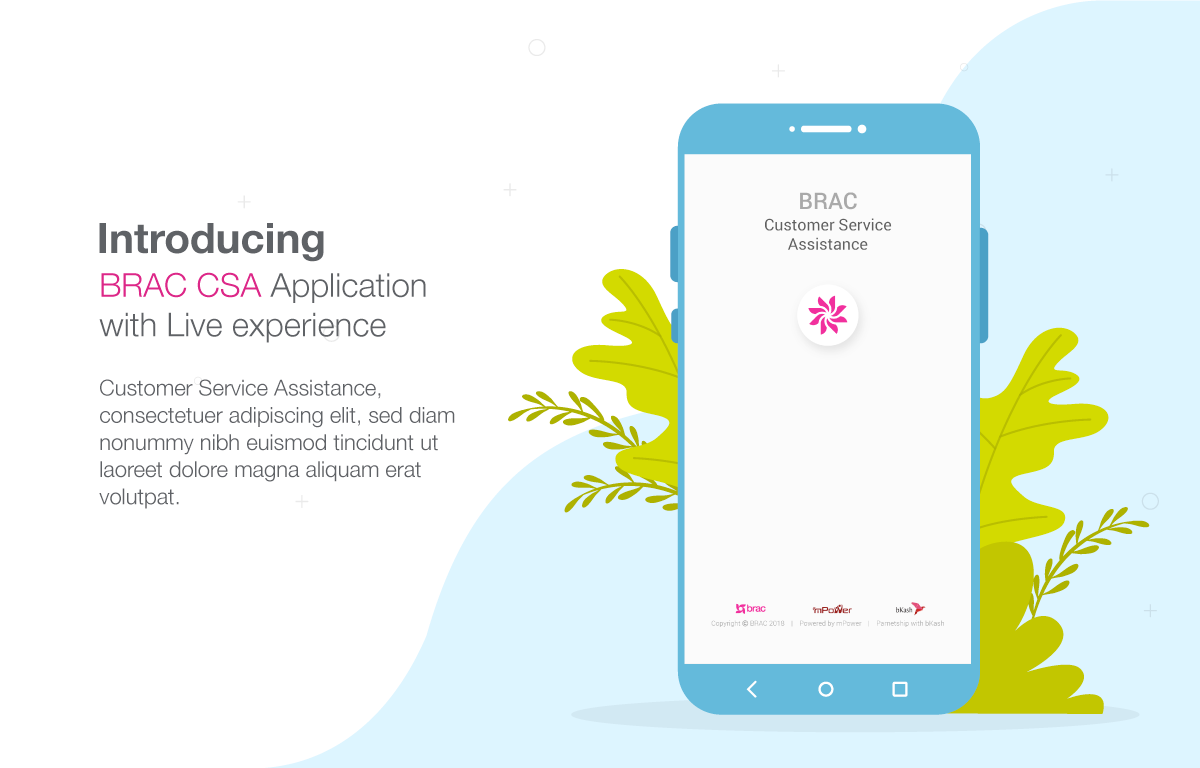

App Story

BRAC wanted to enhance financial inclusion for low-income, low educated rural women of Bangladesh. Hence a programme had to be designed in such a way that barriers like social norms and economic condition were removed but there could be no shortcuts either. Women clients have to endure a male dominated and intimidating environment every time they visit the bKash agents. Furthermore, bKash Plus service centres are 20km away on average. Together, these factors led to the thought of a CSA app. What if the women clients could just visit the nearest BRAC office and get the necessary services within half an hour?

Women clients can have their PINs reset, open a new account, block or unblock their account, update their information or check their transaction history through this newly introduced CSA app.

An overriding priority of the CSA app was that it had to be user friendly and the interface had to be very simple. BRAC commissioned mPower to build an app with functions proven crucial for our women client. This app would be handled by BRAC personnel, we call them Customer Service Assistant (CSA), who would double as bKash service agents.

“We had to get bKash on board and on the same page about what we wanted to do,” said Akramul Haider, BRAC’s Lead Software Engineer, who led the app development process.

The new app would be used to open new accounts, reset pins, unlock an account and such functions that required full access to bKash system. “That is what made this particularly complicated and set this project apart from others,” said Wasifa Noshin, Management Trainee of bKash. She said it was not just the front end that was the matter, but we had work on the back end and the interface as well.

“Further, there were three parties — mPower, which was building the app, and then there were bKash and BRAC. Getting all the parties on the same page and ironing out the details was in itself a challenge.”

Wasifa Noshin said the app had to be extremely simple and

user friendly. “It would be used by BRAC’s customer service agents, many of

whom may not be very tech savvy but they would be performing complicated

functions.”

Akramul Haider explained that given the poor literacy level and inexperience,

many clients often had complaints or queries. They would sometimes inadvertently

get locked out of their account or simply forget their PINs. The CSA app

addresses exactly such problems.

He said the app is complete in itself. “It can even take photos and embed them into an application for new accounts.” He is hopeful that after a successful pilot phase, the app will be rolled out to all the customer service assistants of BRAC across Bangladesh.

It also includes features that reduce work for BRAC personnel and give faster services. This app can work both online and offline, which means the customer service assistants save requests or filled out forms and concentrate more on the urgent requests. Later when they have more time on their hands, the CSAs deal with all the saved requests and forms.

Provide hands-on ‘teaching’ rather than ‘lecturing’

BRAC’s Integrated Development Programme (IDP) is a long term project that aims to improve socioeconomic conditions and livelihoods of 1.1 million poor people living in remote areas by 2020. IDP provides multifaceted support through a single platform that includes education, healthcare, sustainable livelihood and activities that promote women’s empowerment. It is convenient for IDP clients to make mobile financial transactions as IDP primarily focuses on the development of remote areas such as the haors (floodplains) and chars (shoals).

Prior to July 2016, clients received training on mobile menu navigation once every month when BRAC field officials paid them a visit. Given that the nearest branch is often more than 5km away, many women were unable to visit BRAC offices for additional support. BRAC realised that if it wanted to turn women clients into proficient users, it needed to provide rigorous, continuous training in the field.

That was how a five-day mobile money training was born. Divided into discrete 45-minute sessions, this training is always delivered in the local dialect with stories in the local context. At the end of five days, a participant is selected as a local trainer and tasked with assisting neighbours in using their wallets. Thus far, 58,000 IDP clients have received this training which enables them to use basic bKash services including cash-in, cash-out, and transfer. They can also pay loan installments, make savings deposits, and recharge their mobile accounts.

Build confidence in technology

BRAC developed an online app to guide the CSAs in 2016 to troubleshoot problematic issues for clients and provide them support. This app allowed BRAC staff to check the validity of a national ID and immediately ascertain whether it had already been used for another account. Hence, rejection rates were reduced. Often, users would forget their PIN codes and inadvertently lock their accounts. CSAs can unlock such accounts through the app, which means that women do not need to visit the bKash service centre which is often half a day’s commute away.

Constantly on the lookout for ways to improve client experience, BRAC is collaborating with bKash to redesign the CSA app. The initial version proved to be difficult for CSAs to navigate; viewing transaction histories was also a challenge because the app frequently timed out. It has been updated since, with new icons for smoother navigability and an option to work offline. All CSAs will also be provided a tablet with the app preinstalled. This means that during busy office hours, CSAs can serve a greater number of clients with minimal waiting time. Data can be entered into the app, saved and later modified before sending final requests to bKash. If there is an emergency request from a client, the CSAs can submit it online and receive answers within half an hour. The revamped app will roll out across branch offices in Spring 2019.

BRAC has about 700 CSAs who have so far opened 254,082 accounts. Compared to the crowded agent points, the BRAC offices are much more comfortable for women to ask questions, explore wallet functionality, and correct mistakes without judgment.

App-Slide1

The digital way forward (below)

The digital way forward

BRAC has spent the past five years identifying and addressing primary barriers to mobile money adoption for women. The largest NGO will have opened over 1 million bKash accounts across the country by 2019 and trained more than six million clients, mostly women. From digitizing salaries to promoting bKash for savings schemes, BRAC has identified ways to catalyse financial inclusion through mobile money.…

The power of mobile money to transform the economic lives of women — and their larger networks — is clear. And BRAC is trying to make full use of that potential as it strives to develop products and services targeting new population segments to ensure that no woman is left behind on the journey to financial inclusion. This includes digitisation of wages for ready-made garment workers and piloting loan products for Facebook-based entrepreneurs. Achieving gender equality in financial services, however, will require a multifaceted response that reaches far beyond ensuring meaningful access. Most critically, regulators will need to explore ways to further foster use of mobile money by lifting transaction fees and limits, for instance. Research demonstrates that women transact with mobile money at a lower rate than men due to greater price sensitivity. If partners across Bangladesh can come together in developing a regulatory environment conducive to inclusivity, then financial inclusion for all will not remain a dream any more. It will become the reality.

Driving a cashless ecosystem

When BRAC began its work with the Innovation Fund in 2013, it had not anticipated the extent to which the impact of mobile money training would spill over. Women have proven themselves to be agents of change, driving grassroots uptake of mobile money within and beyond their immediate network. If a woman adopts mobile money, it creates significant ripple effects throughout the larger ecosystem. She will in turn introduce it to her family, friends, and neighbors. Women have also proven themselves to be significant drivers of economic growth.

Increasing financial inclusion for women through access to mobile money in turn creates a more efficient, productive, and transparent economy.