By Moonmoon Shehrin

“I was about to sell my cow to finance the expenses of my gall-bladder surgery” – A client who took a medical treatment loan

“My daughter had high fever for several days. Since my husband is a daily laborer, we had to borrow from local moneylenders. Since then our lives have become more difficult. We are struggling to pay our debts taken at exorbitant rates.”

Did you know that 64% of health expenditures in Bangladesh are financed through out of pocket payments? Even access to quality health services continues to be inadequate and expensive for a large segment of the country’s population. Every year, a significant number of people are driven below the poverty line as a result of disproportionate spending on their health.

Health related emergencies often induce clients to liquidate family and business assets; even defaulting on repayment of loans and savings deposits. Sometimes clients even borrow from informal lenders at exorbitant rates to fulfill their medical needs. Thereby, affecting their capacity to repay loans or save with their microfinance institution. Stories like: “I borrowed 1500tk from a money lender and ended up paying 3000tk to him. The money lenders take advantage of the situation and charge high interest rates. If I am unable to pay installments then they will drag me out of my house” are common from the borrower. For these reasons, health loans at an affordable interest rate are especially valuable to clients during emergencies, when they have few readily available financing options.

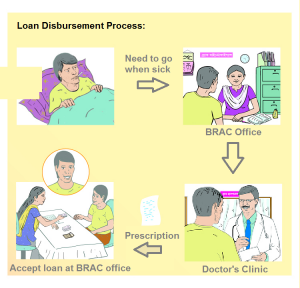

Therefore, we launched a pilot project in October 2013 for our existing Microfinance borrowers and their family members, in partnership with the Health Nutrition and Population Program, to provide loans and improve accessibility to reliable health care, thereby, reducing the risk of economic compromise with a goal to yield significant health and social welfare benefits.

We are working with 31 local health service providers, which are selected with the help of our Health program. The synergy between the two BRAC programs helped to expand the pilot to 132 branch offices.

BRAC emphasizes holistic, cohesive and sustainable approaches to eradicate the crisis of funds for treatment. From our field experience over the past one year we are confident about our success in creating a unique product for our clients, which is currently available for nearly 200,000 families.

Moonmoon Shehrin is a Management Professional with the Microfinance Research and Development Unit.